STATE TAX RATES ON BEER |

||||

| EXCISETAX RATES ($ per gallon) |

GENERALSALES TAX APPLIES | OTHER TAXES | ||

| Alaska | 1.07 | n.a. | ||

| Hawaii | 0.93 | Yes | $0.54/gallon draft beer | |

| Minnesota (proposed) | 0.90 | — | under 3.2% – $0.077/gallon, 9% sales tax | |

| South Carolina | 0.77 | Yes | ||

| Washington (1) | 0.76 | Yes | ||

| North Carolina | 0.6171 | Yes | ||

| Alabama | $0.53 | Yes | $0.52/gallon local tax statewide | |

| Florida | 0.48 | Yes | ||

| Mississippi | 0.4268 | Yes | ||

| Utah | 0.41 | Yes | over 3.2% – sold through state store | |

| New Mexico | 0.41 | Yes | ||

| Oklahoma | 0.40 | Yes | under 3.2% – $0.36/gallon; 13.5% on-premise | |

| Maine | 0.35 | Yes | 7% on-premise saales tax | |

| Georgia | 0.32 | Yes | $0.53/gallon local tax | |

| Louisiana | 0.32 | Yes | $0.048/gallon local tax | |

| Nebraska | 0.31 | Yes | ||

| New Hampshire | 0.30 | n.a. | ||

| South Dakota | 0.27 | Yes | ||

| Vermont | 0.265 | Yes | more than 6% alcohol – $0.55; 10% on-premise sales tax | |

| Virginia | 0.26 | Yes | ||

| Connecticut | 0.24 | Yes | ||

| Arkansas | 0.23 | Yes | 3% off- 10% on-premise tax | |

| Illinois | 0.231 | Yes | $0.29/gallon in Chicago and $0.06/gallon in Cook County | |

| Michigan | 0.20 | Yes | ||

| California | 0.20 | Yes | ||

| Texas | 0.20 | Yes | 14% on-premise and $0.05/drink on airline sales | |

| U.S. Median | $0.350 | |||

| Iowa | 0.19 | Yes | ||

| Kansas | 0.18 | — | over 3.2% – {8% off- and 10% on-premise}, under 3.2% – 4.23% sales tax | |

| Ohio | 0.18 | Yes | ||

| West Virginia | 0.18 | Yes | ||

| Arizona | 0.16 | Yes | ||

| Nevada | 0.16 | Yes | ||

| North Dakota | 0.16 | — | 7% state sales tax, bulk beer $0.08/gal. | |

| Delaware | 0.16 | n.a. | ||

| Idaho | 0.15 | Yes | over 4% – $0.45/gallon | |

| Minnesota (current) |

0.15 | — | under 3.2% – $0.077/gallon, 9% sales tax | |

| New York | 0.14 | Yes | additional $0.12/gallon in New York City | |

| Montana | 0.14 | n.a. | ||

| Tennessee | 0.14 | Yes | 17% wholesale tax | |

| New Jersey | 0.12 | Yes | ||

| Indiana | 0.115 | Yes | ||

| Massachusetts | 0.11 | 0.57% on private club sales | ||

| Rhode Island | 0.10 | Yes | $0.04/case wholesale tax | |

| Maryland | 0.09 | — | 9% sales tax; $0.2333/gallon in Garrett County | |

| Dist. of Columbia | 0.09 | Yes | 9% off- and on-premise sales tax | |

| Oregon | 0.08 | n.a. | ||

| Kentucky | 0.08 | Yes | 11% wholesale tax; * general sales tax applies to on-premise sales only | |

| Colorado | 0.08 | Yes | ||

| Pennsylvania | 0.08 | Yes | ||

| Wisconsin | 0.06 | Yes | ||

| Missouri | 0.06 | Yes | ||

| Wyoming | 0.02 | Yes | ||

| U.S. Median

|

$0.350

|

|

|

|

| Source: Federation of Tax Administrators http://www.taxadmin.org (January 1, 2013) | ||||

| Note: n.a. = not applicable. These 5 states do not have a general sales tax. | ||||

| (1) An additional $15.50/barrel tax will expire on 6/30/2013, reducing the tax rate to 0.26/gallon. | ||||

Category Archives: Newsfeed

MN Beer Activists feed of news, events, education, legislation related to beer, wine, and spirits in Minnesota.

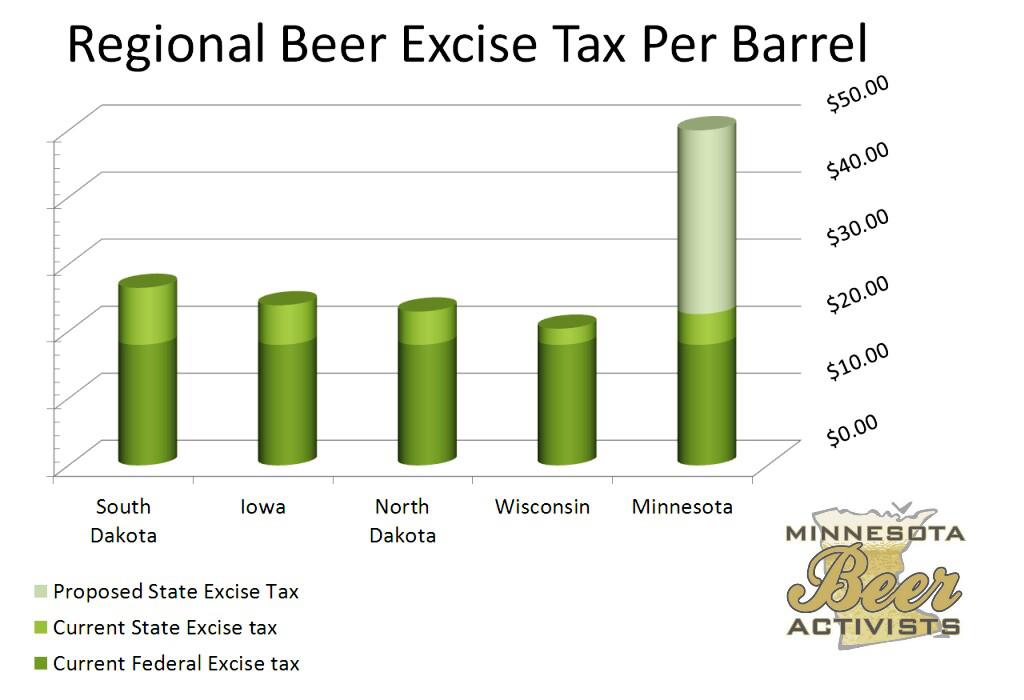

How Minnesota Excise Tax Compares to Neighboring States

This striking visual shows how out of step Minnesota will be if the proposed legislation passes. The proposed tax would make it about twice as expensive to produce beer in Minnesota than any other neighboring state.

Big Brew Day

House Passes Omnibus Tax Bill

The House of Representatives passed their version of the Tax Omnibus Bill HF 677. Included in the bill is a substantial excise tax increase that has been largely opposed by Minnesota breweries, wineries, distilleries, wholesalers, distributors, restaurants, pubs, bars, and consumers.

Below is a record how Representatives in the House voted and the contested language.

You can find an official voting record here. And the contested bill here.

Those who voted for the increase:

| Allen | Anzelc | Atkins | Benson, J. | Bernardy |

| Bly | Brynaert | Carlson | Clark | Davnie |

| Dehn, R. | Dill | Dorholt | Erhardt | Erickson, R. |

| Falk | Faust | Fischer | Freiberg | Fritz |

| Hansen | Hausman | Hilstrom | Hornstein | Hortman |

| Huntley | Isaacson | Johnson, C. | Johnson, S. | Kahn |

| Laine | Lenczewski | Lesch | Liebling | Lien |

| Lillie | Loeffler | Mahoney | Mariani | Marquart |

| Masin | McNamar | Melin | Metsa | Moran |

| Morgan | Mullery | Murphy, E. | Murphy, M. | Nelson |

| Newton | Norton | Paymar | Pelowski | Persell |

| Poppe | Savick | Sawatzky | Schoen | Simon |

| Simonson | Slocum | Sundin | Thissen | Wagenius |

| Ward, J.A. | Ward, J.E. | Winkler | Yarusso |

Those who voted in the against the increase:

| Abeler | Albright | Anderson, M. | Anderson, P. | Anderson, S. |

| Barrett | Beard | Benson, M. | Cornish | Daudt |

| Davids | Dettmer | Drazkowski | Erickson, S. | Fabian |

| FitzSimmons | Franson | Garofalo | Green | Gruenhagen |

| Gunther | Hackbarth | Halverson | Hamilton | Hertaus |

| Holberg | Hoppe | Howe | Johnson, B. | Kelly |

| Kieffer | Kiel | Kresha | Leidiger | Lohmer |

| Loon | Mack | McDonald | McNamara | Myhra |

| Newberger | Nornes | O’Driscoll | O’Neill | Peppin |

| Petersburg | Pugh | Quam | Radinovich | Rosenthal |

| Runbeck | Sanders | Schomacker | Scott | Selcer |

| Swedzinski | Theis | Torkelson | Uglem | Urdahl |

| Wills | Woodard | Zellers | Zerwas |

59.32 Sec. 12. Minnesota Statutes 2012, section 297G.03, subdivision 1, is amended to read:

59.33 Subdivision 1. General rate; distilled spirits and wine. The following excise tax is

59.34imposed on all distilled spirits and wine manufactured, imported, sold, or possessed in

59.35this state:

60.23In computing the tax on a package of distilled spirits or wine, a proportional tax at a

60.24like rate on all fractional parts of a gallon or liter must be paid, except that the tax on a

60.25fractional part of a gallon less than 1/16 of a gallon is the same as for 1/16 of a gallon.

60.26EFFECTIVE DATE.This section is effective July 1, 2013.

60.27 Sec. 13. Minnesota Statutes 2012, section 297G.03, is amended by adding a

60.28subdivision to read:

60.29 Subd. 5. Small winery credit. (a) A qualified winery is entitled to a tax credit of

60.30$2.08 per gallon on 50,000 gallons sold in any fiscal year beginning July 1. Qualified

60.31wineries may take the credit on the 18th day of each month, but the total credit allowed

60.32may not exceed in any fiscal year the lesser of:

60.33(1) the liability for tax; or

60.34(2) $104,000.

60.35(b) For purposes of this subdivision, a “qualified winery” means a winery, whether

60.36or not located in this state, producing less than 100,000 gallons of wine in the calendar

60.37year immediately preceding the calendar year for which the credit under this subdivision

60.38is claimed. In determining the number of gallons, all brands or labels of a winery must

60.39be combined. All facilities for the production of wine owned or controlled by the same

60.40person, corporation, or other entity must be treated as a single winery.

61.1EFFECTIVE DATE.This section is effective July 1, 2013.

61.2 Sec. 14. Minnesota Statutes 2012, section 297G.04, is amended to read:

61.3297G.04 FERMENTED MALT BEVERAGES; RATE OF TAX.

61.4 Subdivision 1. Tax imposed. The following excise tax is imposed on all fermented

61.5malt beverages that are imported, directly or indirectly sold, or possessed in this state:

61.6(1) on fermented malt beverages containing not more than 3.2 percent alcohol by

61.7weight, $2.40 $25.55 per 31-gallon barrel; and

61.8(2) on fermented malt beverages containing more than 3.2 percent alcohol by

61.9weight, $4.60 $27.75 per 31-gallon barrel.

61.10For fractions of a 31-gallon barrel, the tax rate is calculated proportionally.

61.11 Subd. 2. Tax credit. A qualified brewer producing fermented malt beverages is

61.12entitled to a tax credit of $4.60 $27.75 per barrel on 25,000 50,000 barrels sold in any

61.13fiscal year beginning July 1, regardless of the alcohol content of the product. Qualified

61.14brewers may take the credit on the 18th day of each month, but the total credit allowed

61.15may not exceed in any fiscal year the lesser of:

61.16(1) the liability for tax; or

61.17(2) $115,000 $1,387,500.

61.18For purposes of this subdivision, a “qualified brewer” means a brewer, whether or

61.19not located in this state, manufacturing less than 100,000 200,000 barrels of fermented

61.20malt beverages in the calendar year immediately preceding the calendar year for which

61.21the credit under this subdivision is claimed. In determining the number of barrels, all

61.22brands or labels of a brewer must be combined. All facilities for the manufacture of

61.23fermented malt beverages owned or controlled by the same person, corporation, or other

61.24entity must be treated as a single brewer.

61.25EFFECTIVE DATE.This section is effective July 1, 2013.

As time allows voting records will be updated with contact links and party affiliation.

Unintended Consequences: The Maine Law and Lager

As the Minnesota legislature contemplates a massive tax increase on brewers and distillers we may be reminded of a time in the 1920’s when state and federal governments decided to punish beer drinkers for the supposed good of everyone. The Prohibition era of the 20th century was not the first instance of this in American or Minnesota history. To find the true roots of this misguided movement we must travel back to Portland, Maine in the 1840’s. It was in this city that temperance and prohibition took their first breaths.

In 1827 Neal Dow became a founding member of the Maine Temperance Society. Most temperance advocates tried to convince people of the danger of drink but Dow believed that the only way to eliminate alcohol was by legislation. He used his influence to attempt prohibition in Maine several times before being elected mayor of Portland in April 1851. In that same year he succeeded in shepherding the first prohibition law in the nation through Maine’s legislature. With the “Maine” law in effect it would spread like a virus through the northern states. Minnesota would pass its own version of the Maine law in 1852.

Early prohibition would meet its nemesis in the German beer cultures of Milwaukee and St. Louis. German immigrants and their descendants viewed prohibition as an attack on the very lifeblood of their culture. Unlike the Northeastern Yankees, who drank heavier British style ales or rum, Germans preferred the lager beer of their homeland. Lager was considerably lighter and lower in alcohol than ale and many Germans enjoyed it in community beer gardens or other social events. As Midwesterners this should not be an altogether unfamiliar situation for most of us. In that culture beer was not viewed as an intoxicant but an everyday beverage to relax, enjoy, and be sociable.

The reaction in Milwaukee and St. Louis to prohibition should not have come as a great surprise to the temperance advocates in those states. The vehemence in the rejection of temperance came in the form of riots and mass protests at state capitols. A prohibition act did reach the Governor’s desk in Wisconsin in 1853 but was promptly vetoed. In St. Louis there was another idea entirely. There German-Americans would go to court to prove that lager beer was not an intoxicating beverage. In one story, a portly German man volunteered his time to sit in front of jurors and consume 22 beers to prove that he could not become drunk from beer.

While the Maine laws stalled in Wisconsin and Missouri they came under attack in the state where they were born. On June 2, 1855 Portland residents rioted after hearing a rumor the Neal Dow himself had sold alcohol for medicinal purposes to the state. When the rioter reached his steps he ordered the state militia to fire killing one and injuring several. This incident was repeated across other dry states. In 1856 Maine repealed Prohibition which led to repeal in several other states as crusaders focused on a different cause, abolition.

This first attempt at Prohibition taught American several lessons one being that denying people a popular product caused more problems than it solved. Minnesota would change its law because it had not counted on the reduced revenue from the lack of liquor and beer taxes. An unintended consequence of Maine laws was the popularity of lager beer. The publicity from the protests by German-Americans would lead many to try this new lager beer. Since then lager beer has become the most popular style of beer in America for more than 150 years. So go out and find a locally brewed lager or pilsner and salute our ancestors for holding off Prohibition for 80 years by teaching America how to drink beer again.

Video: Beer Taxes on KSTP at Issue

Summit Brewery Founder Mark Stutrud Talks beer taxes with Tom Hauser on At Issue, on KSTP.

Source: KSTP

Grain Belt – Putting the American in American Lager

The August Schell Brewing Co. has launched a new Grain Belt marketing campaign featuring the phrase, “We are the American in American Lager.” The goal for the new campaign is to evoke the pride and spirit of loyal Grain Belt drinkers.

Schell’s has invited Grain Belt Facebook fans to share pictures and stories of themselves enjoying the hobbies, passions and experiences that make them proud to be American. To enter the contest you need to share your distinctly American experience (with a Grain Belt beer, of course) to the contest event on the Grain Belt Facebook page.

Schell’s has invited Grain Belt Facebook fans to share pictures and stories of themselves enjoying the hobbies, passions and experiences that make them proud to be American. To enter the contest you need to share your distinctly American experience (with a Grain Belt beer, of course) to the contest event on the Grain Belt Facebook page.

A new topic will be highlight each month. April’s theme is American restoration. Think of of something like your head under the hood of your ’55 Chevy and a cold Grain Belt on the fender.

At the end of every month a winner will be chosen, and featured in a Grain Belt ad along with their project. A Grain Belt product, your name ,and hometown will also be used in the winning advertisement. The winner will receive a large commemorative Marti family signed printed version of the ad.

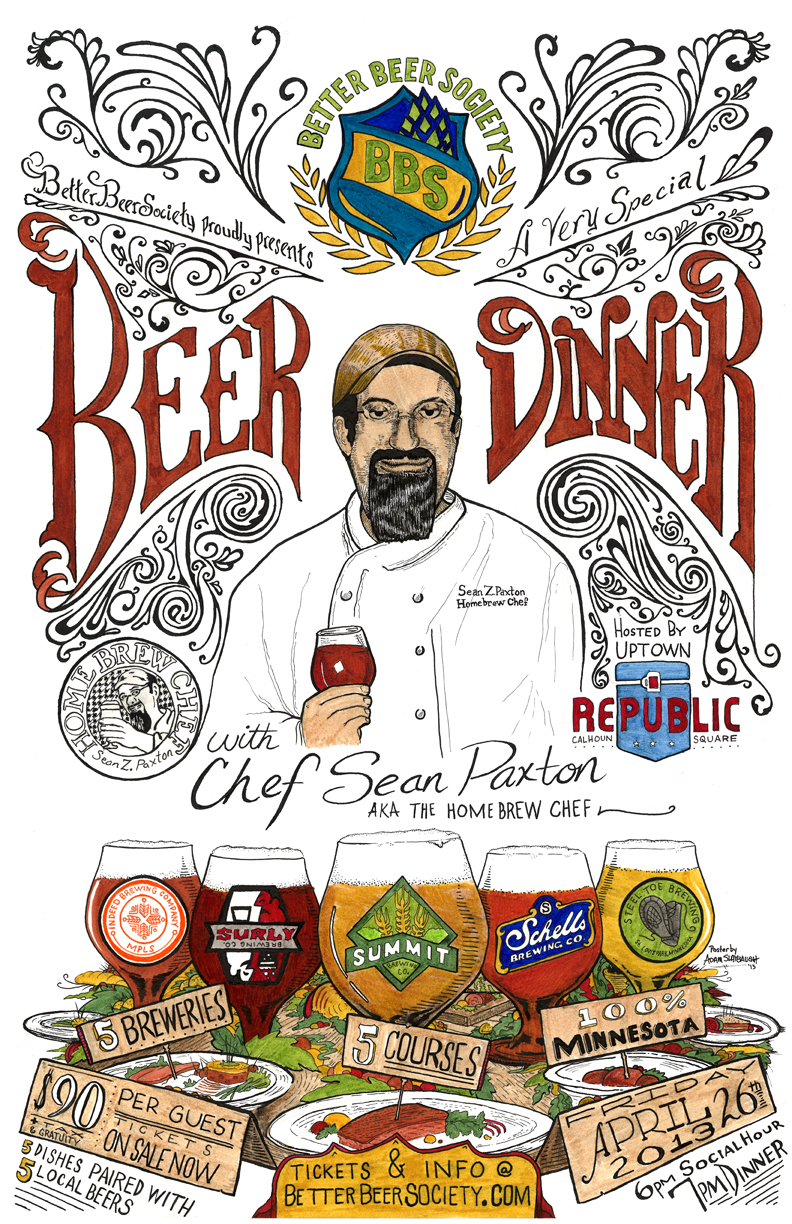

Better Beer Society / Homebrew Chef Educational Beer Dinner

The Better Beer Society proudly presents a very special beer dinner with famed beer chef Sean Z. Paxton (aka – The Homebrew Chef).

Chef Paxton hails from San Francisco is arguably the most famous beer chef in the world, creating beer dinners for some of the best craft breweries in the nation, as well as for Brewers Association events such as the Craft Brewers Conference and the Great American Beer Festival. In addition, he is a respected author and hosts a monthly podcast on The Brewing Network.

Chef Paxton hails from San Francisco is arguably the most famous beer chef in the world, creating beer dinners for some of the best craft breweries in the nation, as well as for Brewers Association events such as the Craft Brewers Conference and the Great American Beer Festival. In addition, he is a respected author and hosts a monthly podcast on The Brewing Network.

Better Beer Society is a Twin Cities based educational organization dedicated to the growth and awareness of craft beer in Minnesota. BBS provides education through staff training at the retail level, as well as on the consumer level with its highly attended Better Beer Society University program.

The Homebrew Chef has recently partnered with the Better Beer Society on a collaboration dinner showcasing 5 of Minnesota’s craft breweries. Together we’re bringing education to the table as we present the concept and technique of cooking with beer and beer ingredients, as well as the presenting the principles of pairing beer with food.

Join BBS on Friday April 26th at Republic in Uptown, as they present what is sure to be a beer dinner unlike any other you’ve experienced. You will also be joined by Brewmasters and owners of the following brewing companies: Surly, Schell’s, Indeed, Summit, and Steel Toe.

Tickets are $90 (not including tip + gratuity), and reservations are being taken by phone. Please contact 612.886.2309 to reserve your seat(s), as space is limited and this event will sell out fast. Social hour @ 6pm / Dinner @ 7pm.

For more information on Better Beer Society or this event, please contact Rob Shellman directly at rob@betterbeersociety.com or 612.226.7622

What: Better Beer Society / Homebrew Chef Educational Beer Dinner

When: Friday April 26th / 6pm

Where: Republic Calhoun Square