Taxes

It has been a while since the liquor excise tax has increased in Minnesota, and there is a movement afoot at the Capitol to change that.

The House Tax Omnibus HF 677, will increase the tax on liquor, wine, and beer in Minnesota by substantial amounts, as will the Senate version. There are a few differences between the bills. Both have massive increases, but the senate version creates an impact fund to go toward nonprofit entities that run substance abuse programs.

The tax increase is being sold as a mere pennies-per-pint increase, a notion that is entirely false. In actuality, the tax increase is far more than a few pennies per pint. The proposed state excise tax has an increase from $4.60 to $27.75 per 31-gallon barrel. This is a 6-fold increase to one of the few industries showing growth in Minnesota.

Here is the terrible part about the tax increase; it gets passed to you, the consumer. Brewers aren’t just going to pay the extra cost to the state and be done with it. To cover the increase, brewers will increase the price that wholesalers pay, then wholesalers will pass that increase to retailers, and retailers will pass it to you. Say what you want about the 3-tier system, but this is the system we have and it isn’t going away soon.

Follow along for some math fun!

Under the current tax structure:

Local brewery sells keg for $200

Wholesaler sells keg for $260 (30% increase)

Bar/store sells keg for $338 (30% increase)

Under the proposed tax structure:

Local brewery sells keg for $227

Wholesaler sells keg for $295 (same 30% increase)

Bar/store sells keg for $384 (same 30% increase)

See how a $27 tax can quickly become a $46 per Bbls increase? Include the federal excise tax, state sales tax, state alcohol tax, and local taxes, it is obvious that the government likes to dip its beak into your beer and drink heartily.

I think it is a really, really bad thing.

– Jacquie Berglund, Founder and CEO of FINNEGANS Inc.

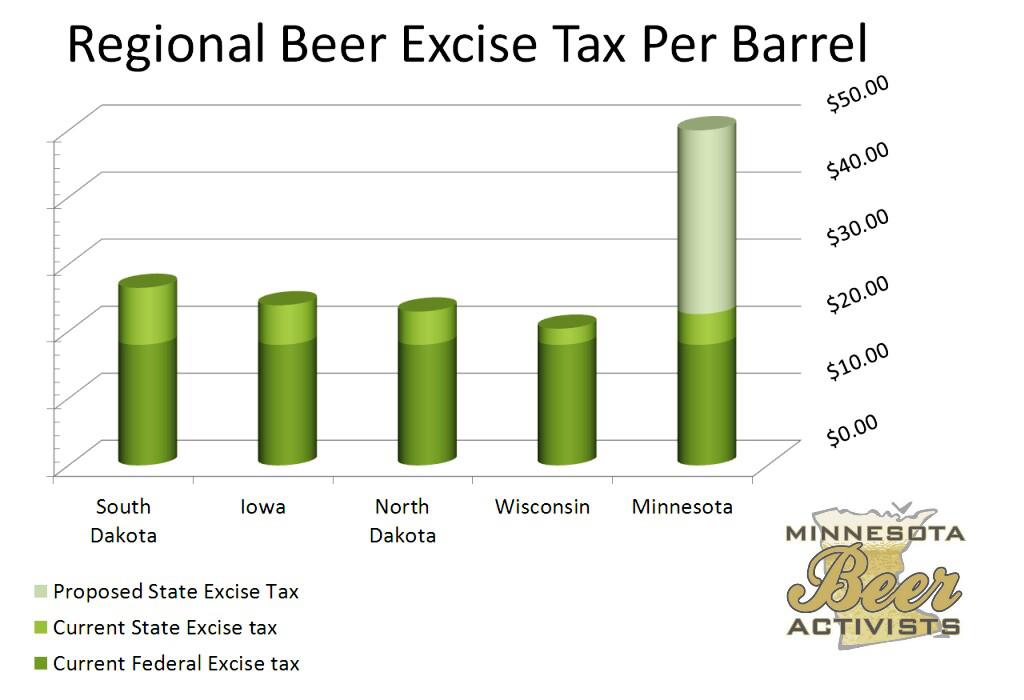

But, not all governments are created equal. Of the surrounding states, Minnesota is currently in the middle of the pack when it comes to excise tax. South Dakota has a higher state excise tax at $8.50 a Bbls, and Wisconsin only taxes $2.40 a Bbls. It is worth noting that South Dakota is the only other state in the region that also has a special Alcohol Tax. The South Dakota special alcohol tax is 2%, and we beat them at 2.5% on gross receipts.

Death

Proponents of the tax increase claim that the extra tax revenue will offset the cost counties pay to run addiction centers and other alcohol-related medical expenses. If the idea is to offset the county costs, why is the tax revenue going into the state general fund? If counties like Hennepin are interested in offsetting the cost alcohol has on society, they should tax it at the county level. In fact, there are already numerous special taxes in downtown Minneapolis as they tax everything from dancing to liquor.

Breweries in Minnesota are doing their best to catch up to the rest on the country. You will read all kinds news about the craft brewery explosion in Minnesota, but there are over 2,500 breweries in the country and we have less than 50. We are a good deal behind the rest of the nation when it comes to enjoying local craft beer. Increasing the cost to operate a brewery will only hinder the growth we’ve begun to see.

The only silver lining in the proposed tax increase is a provision that gives a credit to brewers on the first 50,000 Bbls brewed in a year. The tax credit is nice, but it leaves breweries like Summit, Schell’s, and Cold Spring to pay a substantial amount of the tax. The 50,000 ceiling is puzzling. Nationally, brewers that produce less than 6 Mil Bbls a year are considered small. A tax credit on 50,000 Bbls a year doesn’t do much to soften the blow of the proposed tax increase.

Unlike local wine and beer producers, there is no protection for local craft distillers in the proposed tax increase. Local distilling is an even smaller industry than brewing and wineries. Small distilleries are only beginning to have a presence here in Minnesota. Is the idea to collect more taxes from distillers, or make sure there are none here to pay the tax?

Minnesota is the home of prohibition and Andrew Volstead, but that doesn’t have to be our legacy. Prohibition is dead. Volstead is dead. This tax increase needs to die, too.