The House and Senate version of the Tax Omnibus bill are in conference committee to hash out differences between the bills. The House version has a steep increase alcohol taxes. You can links and language below.

We’ve created StopMnDrinkTax.org to give you an easy resource for contacting your legislators. Please, use it and share it with your friends.

Rep. Paul Thissen– Click here to email

Call: 651-296-5375

Sen Tom Bakk– Click here to email

(651) 296-8881

Link to the Senate version.

Link to the House Version.

House language pertaining to excise tax.

59.32 Sec. 12. Minnesota Statutes 2012, section 297G.03, subdivision 1, is amended to read:

59.33 Subdivision 1. General rate; distilled spirits and wine. The following excise tax is

59.34imposed on all distilled spirits and wine manufactured, imported, sold, or possessed in

59.35this state:

| 60.1 | Standard | Metric | |||

| 60.2 60.3 60.4 |

(a) Distilled spirits, liqueurs, cordials, and specialties regardless of alcohol content (excluding ethyl alcohol) |

$ | 11.02per gallon |

$ | 2.91per liter |

| 60.5 60.6 60.7 60.8 |

(b) Wine containing 14 percent or less alcohol by volume (except cider as defined in section<statute_ref>297G.01, subdivision 3a ) |

$ | 2.08 per gallon |

$ | .55per liter |

| 60.9 60.10 60.11 |

(c) Wine containing more than 14 percent but not more than 21 percent alcohol by volume |

$ | 2.73 per gallon |

$ | .72per liter |

| 60.12 60.13 60.14 |

(d) Wine containing more than 21 percent but not more than 24 percent alcohol by volume |

$ | 3.64 per gallon |

$ | .97per liter |

| 60.15 60.16 |

(e) Wine containing more than 24 percent alcohol by volume |

$ | 5.34 per gallon |

$ | 1.42per liter |

| 60.17 60.18 |

(f) Natural and artificial sparkling wines containing alcohol |

$ | 3.60 per gallon |

$ | .95per liter |

| 60.19 60.20 |

(g) Cider as defined in section<statute_ref>297G.01, subdivision 3a |

$ | 1.93 per gallon |

$ | .51per liter |

| 60.21 60.22 |

(h) Low-alcohol dairy cocktails | $ | 1.36 per gallon |

$ | .36per liter |

60.23In computing the tax on a package of distilled spirits or wine, a proportional tax at a

60.24like rate on all fractional parts of a gallon or liter must be paid, except that the tax on a

60.25fractional part of a gallon less than 1/16 of a gallon is the same as for 1/16 of a gallon.

60.26EFFECTIVE DATE.This section is effective July 1, 2013.

60.27 Sec. 13. Minnesota Statutes 2012, section 297G.03, is amended by adding a

60.28subdivision to read:

60.29 Subd. 5. Small winery credit. (a) A qualified winery is entitled to a tax credit of

60.30$2.08 per gallon on 50,000 gallons sold in any fiscal year beginning July 1. Qualified

60.31wineries may take the credit on the 18th day of each month, but the total credit allowed

60.32may not exceed in any fiscal year the lesser of:

60.33(1) the liability for tax; or

60.34(2) $104,000.

60.35(b) For purposes of this subdivision, a “qualified winery” means a winery, whether

60.36or not located in this state, producing less than 100,000 gallons of wine in the calendar

60.37year immediately preceding the calendar year for which the credit under this subdivision

60.38is claimed. In determining the number of gallons, all brands or labels of a winery must

60.39be combined. All facilities for the production of wine owned or controlled by the same

60.40person, corporation, or other entity must be treated as a single winery.

61.1EFFECTIVE DATE.This section is effective July 1, 2013.

61.2 Sec. 14. Minnesota Statutes 2012, section 297G.04, is amended to read:

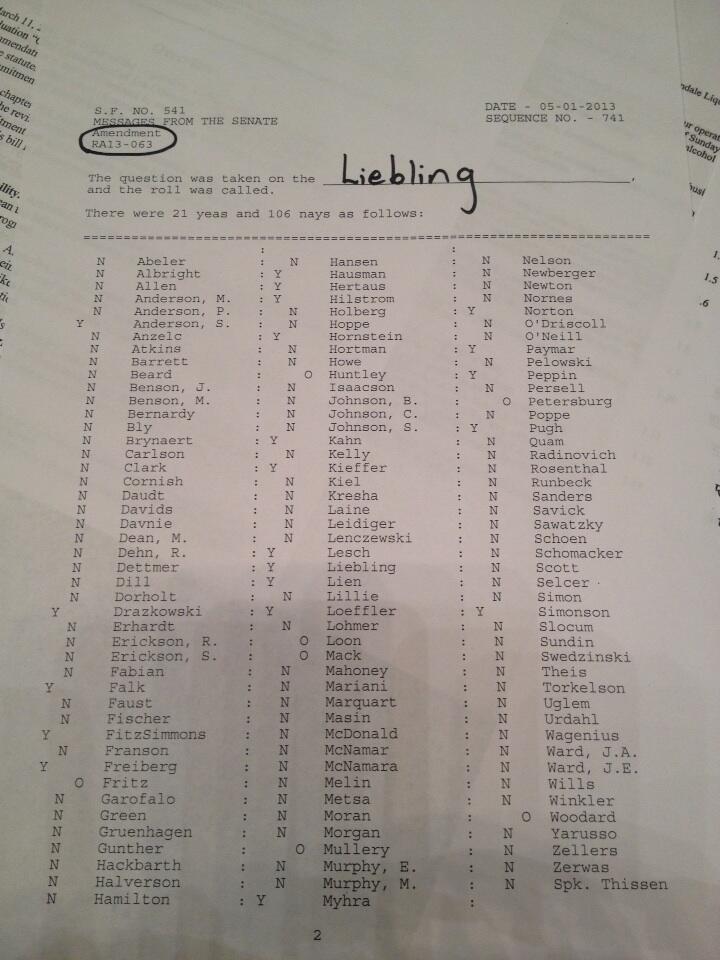

61.3297G.04 FERMENTED MALT BEVERAGES; RATE OF TAX.

61.4 Subdivision 1. Tax imposed. The following excise tax is imposed on all fermented

61.5malt beverages that are imported, directly or indirectly sold, or possessed in this state:

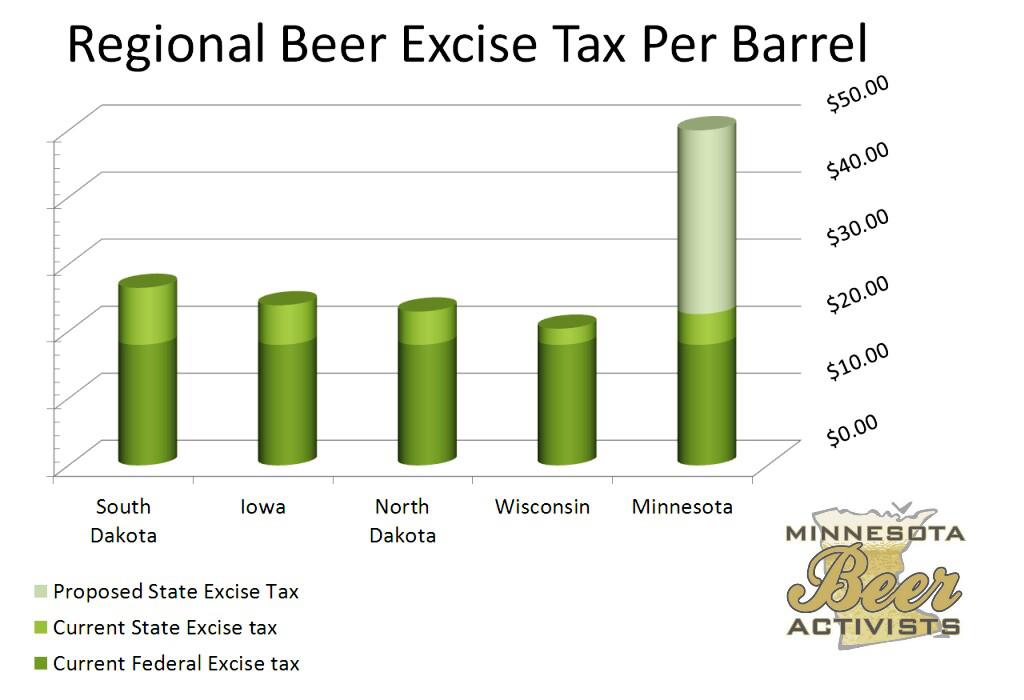

61.6(1) on fermented malt beverages containing not more than 3.2 percent alcohol by

61.7weight, $2.40 $25.55 per 31-gallon barrel; and

61.8(2) on fermented malt beverages containing more than 3.2 percent alcohol by

61.9weight, $4.60 $27.75 per 31-gallon barrel.

61.10For fractions of a 31-gallon barrel, the tax rate is calculated proportionally.

61.11 Subd. 2. Tax credit. A qualified brewer producing fermented malt beverages is

61.12entitled to a tax credit of $4.60 $27.75 per barrel on 25,000 50,000 barrels sold in any

61.13fiscal year beginning July 1, regardless of the alcohol content of the product. Qualified

61.14brewers may take the credit on the 18th day of each month, but the total credit allowed

61.15may not exceed in any fiscal year the lesser of:

61.16(1) the liability for tax; or

61.17(2) $115,000 $1,387,500.

61.18For purposes of this subdivision, a “qualified brewer” means a brewer, whether or

61.19not located in this state, manufacturing less than 100,000 200,000 barrels of fermented

61.20malt beverages in the calendar year immediately preceding the calendar year for which

61.21the credit under this subdivision is claimed. In determining the number of barrels, all

61.22brands or labels of a brewer must be combined. All facilities for the manufacture of

61.23fermented malt beverages owned or controlled by the same person, corporation, or other

61.24entity must be treated as a single brewer.

61.25EFFECTIVE DATE.This section is effective July 1, 2013.